The Kyoto Humanoid Association welcomes Renesas Electronics and other major manufacturers as Japan mounts a coordinated response to China’s overwhelming market dominance in humanoid robotics

Japan, the nation that gave the world ASIMO and pioneered humanoid robotics for decades, is mounting a coordinated counter offensive against Chinese domination of the humanoid robot industry. The Kyoto Humanoid Association (KyoHA), a coalition launched in August 2025 by Waseda University and Murata Manufacturing Co, has expanded to include 13 Japanese electronic components and semiconductor manufacturers, including semiconductor giant Renesas Electronics, in an ambitious effort to mass produce fully Japanese made humanoid robots by 2027.

The expansion, announced in early December 2025, marks a significant escalation in what has become a technology arms race with geopolitical implications. As China positions itself to dominate the global humanoid sports and robotics industry through manufacturing scale and aggressive pricing, Japan is betting on a different strategy, leveraging its world class component manufacturing, precision engineering, and quality reputation to carve out a competitive position.

The Alliance: From Concept to Coordinated Industry Response

The Kyoto Humanoid Association was established in August 2025 as a general incorporated association to address fundamental challenges plaguing Japan’s humanoid robotics sector. According to Waseda University, KyoHA aims to tackle the lack of a domestic hardware development framework and the absence of an integrated industrial structure, weaknesses that have allowed Chinese competitors to surge ahead.

Founding Members

Waseda University: Japan’s leading robotics research institution, home to Professor Kenji Hashimoto’s Mobile Robotics Platform Research laboratory, which has pioneered bipedal robot development for decades.

Murata Manufacturing Co.: Global leader in electronic components, sensors, and precision devices. Murata’s expertise in miniaturization and sensor technology is critical for humanoid development.

tmsuk Co., Ltd.: Kyoto based robotics company founded in 2000, known for innovative practical robotics solutions including disaster rescue robots (the 3.5-meter Enryu), medical training humanoids (Pedia_Roid), and mobility devices (RODEM wheelchair). tmsuk brings commercialization expertise and experience deploying robots in real world applications.

SRE Holdings Corp.: Tokyo based technology investment firm providing financial backing and strategic guidance for the alliance’s ambitious goals.

Recent Expansion

The December 2025 announcement revealed that Renesas Electronics, Japan’s largest semiconductor manufacturer and a global leader in microcontrollers and system on chip solutions, has joined KyoHA alongside additional component manufacturers. The alliance now comprises over a dozen Japanese electronic components and semiconductor manufacturers working toward the 2027 fully Japanese made humanoid goal.

While specific names of all 13 members haven’t been publicly disclosed, the participation of Renesas signals high level semiconductor industry buy in. Renesas’ microcontrollers and embedded systems power millions of automotive, industrial, and IoT devices globally, expertise directly transferable to humanoid robot control systems.

The Mission: Fully Japanese Made Humanoids by 2027

KyoHA’s stated objective is unambiguous: develop and mass produce completely domestically manufactured humanoid robots by 2027. “Fully Japanese made” means sourcing all critical components, sensors, actuators, semiconductors, batteries, structural materials, control systems, and AI software, from Japanese manufacturers.

This represents a direct challenge to China’s supply chain dominance. Currently, even American and European humanoid manufacturers depend heavily on Chinese suppliers for components, creating cost advantages for Chinese robot makers and potential geopolitical vulnerabilities for Western competitors.

Initial Target: 3-Meter Rescue Robot

The alliance’s first major project, announced in June 2025, focuses on developing a 3-meter tall, 300-kilogram humanoid robot for search and rescue operations. Designed specifications include:

- Height: 3 meters (approximately 10 feet)

- Weight: 300 kilograms (660 pounds)

- Walking Speed: 5 km/h (3.1 mph)

- Lifting Capacity: Over 100 kilograms (220+ pounds)

- Applications: Earthquake response, disaster recovery, hazardous environment operations

According to Vietnamese media reporting on the project, participants emphasized that in the context of Japan’s aging population and high frequency of natural disasters, the nation needs to proactively develop rescue robots capable of replacing humans in dangerous missions.

The 3-meter scale is significant, substantially larger than most commercial humanoids under development (typically 160-180 cm). This “giant humanoid” approach targets applications where strength and reach matter more than agility or cost efficiency, differentiating from China’s focus on affordable, mass market humanoids.

Why Japan Needs This Alliance: The Chinese Threat

Japan’s coordinated response through KyoHA stems from recognition that it’s losing a technology race it once dominated. The contrast between Japan’s humanoid robotics position in 2005 versus 2025 is stark.

The ASIMO Era: Japan’s Former Dominance

From 1986 through 2018, Honda’s ASIMO represented the pinnacle of humanoid robotics globally. The program’s retirement in 2018 symbolized Japan’s retreat from consumer humanoid development just as the industry began accelerating.

Japan still maintains strong robotics capabilities in industrial robots (Fanuc, Yaskawa, Kawasaki), service robots (SoftBank’s Pepper), and specialized applications. However, in the critical humanoid market segment, Japan has been overtaken decisively.

China’s Overwhelming Advantages

As Chinese automakers pour billions into humanoid robotics, the scale of China’s advantage becomes clear:

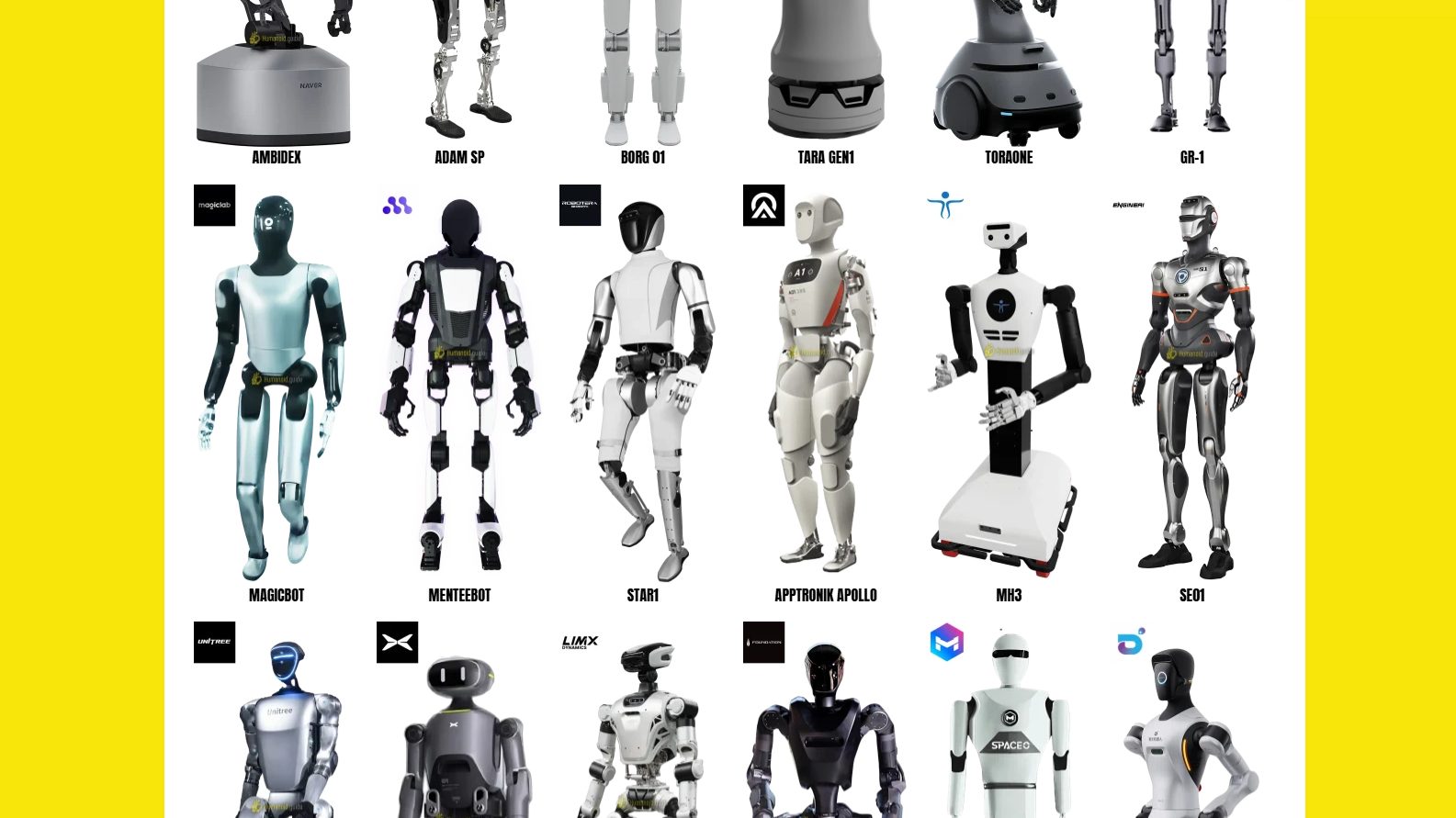

Manufacturing Volume: China recorded over 610 robotics investment deals totaling $7 billion in just the first nine months of 2025, a 250% increase year over year. Over 60 Chinese companies now manufacture humanoids, compared to fewer than 10 in Japan.

Cost Competitiveness: Chinese humanoids like Unitree’s R1 ($5,900) and G1 ($16,000) undercut Japanese development costs by 70-90%. Recent viral demonstrations like EngineAI’s T-800 at $25,000 show Chinese manufacturers achieving combat capable specifications at prices Japanese firms struggle to match.

Supply Chain Control: China dominates global supply chains for actuators, sensors, batteries, and other critical humanoid components. Even non Chinese manufacturers depend on Chinese suppliers, giving China structural cost advantages.

Government Support: China’s national policy identifies humanoid robotics as strategic priority, with coordinated subsidies, research funding, and regulatory support across federal, provincial, and municipal levels. The Chinese Institute of Electronics projects China’s humanoid market will reach $120 billion by 2030.

Market Momentum: Chinese robotics companies like UBTech are seeing explosive growth, with sales hitting 1.3 billion yuan and Walker S2 orders surging as factories rapidly adopt humanoid workers.

Japan’s Risk: Permanent Second Tier Status

Without coordinated action, Japan risks permanent relegation to second tier status in humanoid robotics, the same trajectory that befell Japanese consumer electronics when Korean and Chinese manufacturers achieved scale advantages in TVs, smartphones, and computers.

This matters beyond national pride. Humanoid robotics represents a potential multi hundred billion dollar industry over the next two decades. Japan’s aging demographics create urgent domestic need for care robots, industrial automation, and service humanoids. Depending entirely on Chinese imports for this critical technology creates economic and security vulnerabilities.

The Japanese Strategy: Quality Over Quantity

KyoHA’s approach differs fundamentally from China’s volume focused strategy. Rather than competing on price or production scale, Japan is betting on precision, reliability, quality, and specialized applications where its traditional strengths remain advantages.

Component Excellence

Japan’s electronics and semiconductor industry still leads globally in specific categories:

Sensors: Murata, Omron, and other Japanese firms produce world class sensors for motion detection, force feedback, environmental monitoring, and precision measurement, all critical for humanoid balance and environmental interaction.

Precision Manufacturing: Japanese companies excel at miniaturization, precision tolerances, and quality control, advantages for actuators, joint mechanisms, and structural components requiring exact specifications.

Reliability: Japanese engineering culture emphasizes durability and failure prevention. For applications like elderly care or disaster response where robot failure could endanger humans, reliability premiums justify higher costs.

Advanced Materials: Japan maintains leadership in specialty materials including carbon fiber, advanced polymers, and composite structures that could enable lighter, stronger humanoid frames.

Target Markets: Disaster Response and Eldercare

KyoHA’s focus on 3-meter rescue robots signals strategic positioning in specialized high value niches rather than mass consumer markets.

Disaster Response: Japan’s frequent earthquakes, tsunamis, and typhoons create genuine domestic need for robots that can operate in collapsed buildings, contaminated environments, or dangerous rescue scenarios. These applications justify premium pricing for reliability and capability.

Elderly Care: Japan’s rapidly aging population (29% over age 65, projected to reach 38% by 2065) creates massive demand for care robots. Japanese consumers may prefer domestically produced robots for intimate care applications, creating market protection through cultural preference.

Industrial Precision: Japanese manufacturers in automotive, electronics, and precision manufacturing might prefer Japanese made humanoids for quality critical assembly tasks even at price premiums over Chinese alternatives.

Challenges: Can Quality Beat Scale?

KyoHA faces formidable obstacles in its quest to restore Japanese competitiveness in humanoid robotics.

Cost Disadvantages

Even with coordinated domestic sourcing, Japanese labor costs, regulatory compliance, and smaller production volumes mean Japanese humanoids will likely cost 2-5x more than Chinese equivalents. As the comprehensive humanoid robot database demonstrates, price has become a critical competitive factor in the commercial market.

The question is whether quality premiums can justify this cost gap. History suggests this works only in specific niches. Sony’s AIBO robot dog succeeded as premium product, but Japanese consumer electronics largely lost to cheaper Korean and Chinese alternatives despite quality advantages.

Talent and Culture

Japan’s risk averse corporate culture, which served it well in manufacturing excellence, proves disadvantageous in fast moving robotics startups. Chinese and American companies iterate quickly, embracing failure as learning opportunity. Japanese firms tend toward longer development cycles prioritizing perfection over speed to market.

Additionally, Japan faces demographic challenges in talent availability. As population shrinks and ages, attracting young engineers to domestic robotics firms becomes more difficult when Silicon Valley, Chinese unicorns, or European automotive giants offer global career opportunities.

Regulatory Environment

Japan’s regulatory approach to humanoid robots tends toward caution and extensive safety requirements, appropriate for protecting consumers but potentially slowing commercialization compared to China’s more permissive early stage deployment.

Time Pressure

The 2027 target for mass production of fully Japanese made humanoids is aggressive. Chinese manufacturers are already mass producing and iterating rapidly. By 2027, Chinese humanoids will have logged millions of operational hours in real world deployments, generating invaluable data for AI training and mechanical improvement.

Japan needs to not just match current Chinese capabilities but leapfrog ahead to justify premium positioning. That’s an enormous technical and commercial challenge within a two year timeframe.

International Context: A Broader Technology Competition

KyoHA’s formation reflects broader technology competition dynamics reshaping global supply chains and industrial policy.

The U.S.-China-Japan Triangle

Japan finds itself navigating between the United States (ally and innovation leader) and China (dominant manufacturer and growing competitor). Japanese firms must balance:

- Security Alliance: Close technological and defense cooperation with the United States, including restrictions on exporting sensitive technologies to China

- Economic Reality: Deep integration with Chinese supply chains and consumer markets

- Competitive Pressure: Chinese manufacturers directly threatening Japanese market positions in robotics, EVs, electronics, and consumer goods

KyoHA represents Japan’s attempt to carve autonomous space, developing capabilities independent of both U.S. and Chinese supply chains to maintain technological sovereignty.

Parallel Alliances Emerging

Japan isn’t alone in responding to Chinese humanoid dominance:

South Korea: Hyundai’s acquisition of Boston Dynamics and investments in Rainbow Robotics signal Korean ambitions. ROBOTIS partners with MIT on “Physical AI” development.

Europe: Germany’s automotive giants (BMW, Mercedes-Benz) are deploying humanoids but primarily sourcing from U.S. (Figure AI) or relying on existing industrial robot expertise rather than developing humanoid specific capabilities.

Middle East: Wealthy Gulf states like Saudi Arabia and UAE are investing in humanoid infrastructure, potentially creating markets for premium Japanese humanoids less price sensitive than Chinese domestic buyers.

Taiwan’s Critical Role

While KyoHA emphasizes fully Japanese components, Taiwan’s semiconductor and precision manufacturing capabilities remain critical for advanced humanoid development globally. TSMC’s chip manufacturing, Foxconn’s assembly expertise, and Taiwanese component makers position Taiwan as potential partner for KyoHA, or continued reliance point complicating “fully Japanese” goals.

Implications for Humanoid Sports

While KyoHA’s initial focus targets disaster response and practical applications, implications for humanoid sports are significant.

Premium Competition Leagues

If Japan successfully establishes “quality” positioning for its humanoids, premium sports leagues could emerge featuring Japanese robots competing against each other or against international competitors. Premium pricing could be justified by:

- Reliability: Fewer mid competition failures or malfunctions

- Precision: More accurate movements for sports requiring exact execution

- Safety: Better collision avoidance and failure modes for combat sports

- Durability: Longer operational life justifying higher initial investment

As analysis of which sports humanoids will succeed in indicates, certain sports favor precision and reliability over raw power,potentially favoring Japanese engineering philosophy.

National Pride Competitions

Japan vs. China humanoid sports competitions could become massive cultural events, similar to how Japan-Korea soccer matches or U.S.-China Olympic basketball games generate enormous viewership beyond normal sports audiences.

National pride motivates governments and corporations to invest in sports performance even when commercial ROI is unclear. KyoHA developed humanoids representing Japan in international robot sports could generate cultural value and soft power beyond direct economic returns.

Specialized Sports Formats

Japan might pioneer humanoid sports formats emphasizing qualities where Japanese engineering excels:

- Precision sports: Archery, shooting, gymnastics judged on execution

- Endurance events: Marathon running, ultra endurance competitions

- Technical challenges: Obstacle courses requiring complex problem solving

- Synchronized competitions: Group routines requiring exact coordination

Rather than competing head to head with Chinese combat robots optimized for raw power and cost, Japanese humanoids could define new competition categories where precision, reliability, and sophisticated control systems provide advantages.

The Path Forward: Realistic Assessment

KyoHA represents Japan’s most coordinated response yet to Chinese humanoid dominance, but success is far from guaranteed.

Optimistic Scenario

In the optimistic case, KyoHA achieves its 2027 goals by:

- Successfully coordinating 13+ component manufacturers to create complete domestic supply chain

- Developing 3-meter rescue robot demonstrating superior capability to Chinese equivalents

- Securing Japanese government procurement contracts for disaster response applications

- Establishing “Made in Japan” brand premium for safety critical humanoid applications

- Expanding into eldercare and precision manufacturing niches where quality justifies premium pricing

- Exporting to allied nations and quality conscious markets (Europe, wealthy Asian nations, Middle East)

This scenario positions Japan as the “premium option” in a market otherwise dominated by affordable Chinese humanoids, similar to how German automotive brands maintain premium positioning despite cheaper alternatives.

Pessimistic Scenario

In the pessimistic case, KyoHA struggles with:

- Cost structures making Japanese humanoids 3-5x more expensive than Chinese competitors

- Development delays missing 2027 timeline as coordination challenges slow progress

- Chinese quality improvements eroding Japanese advantages faster than differentiation achieved

- Limited domestic market size insufficient to achieve economies of scale

- Export markets preferring cost effective Chinese robots for most applications

- Talent drain as best engineers join U.S. or Chinese firms offering global opportunities

This scenario sees Japan achieve technical success but commercial failure, producing excellent robots nobody buys at premium prices when “good enough” Chinese alternatives cost dramatically less.

Most Likely Scenario

The realistic outcome probably lies between extremes:

- KyoHA successfully develops fully Japanese humanoids by 2027-2028 (slightly delayed)

- Cost premiums of 50-150% over Chinese equivalents (not 300-500%)

- Success in specific Japanese domestic niches (disaster response, elderly care, precision manufacturing)

- Limited export success outside Japan except for premium applications

- Continued existence as “quality option” preventing complete Chinese monopoly

- Gradual market share erosion as Chinese quality improves and prices remain dramatically lower

This maintains Japanese participation in humanoid robotics but doesn’t restore dominance, similar to Japan’s current position in smartphones (Sony, Sharp) or consumer electronics (Panasonic, Sony), present but not dominant.

Conclusion: David vs. Goliath, Japanese Style

The Kyoto Humanoid Association’s expansion represents more than thirteen companies collaborating on robotics development. It symbolizes Japan’s determination to remain relevant in a technology sector it once dominated but now risks losing entirely to Chinese manufacturing prowess.

The fundamental question is whether coordinated quality focused Japanese engineering can compete economically with China’s manufacturing scale. History offers mixed evidence, Japan succeeded with automotive quality premiums (Toyota, Honda, Lexus) but lost consumer electronics despite quality advantages.

For humanoid sports specifically, KyoHA’s efforts could establish Japan as the “premium option”, robots for serious competitions, professional leagues, and applications where reliability and precision justify cost premiums. This positions Japan as Mercedes-Benz or Rolex equivalent in a market otherwise dominated by more affordable Chinese manufacturers.

Whether this strategy succeeds depends on execution quality, market dynamics, and whether enough consumers value Japanese engineering advantages enough to pay significant premiums. The next two years will reveal whether KyoHA represents a genuine competitive response or symbolic resistance to inevitable Chinese dominance.

One certainty: the global humanoid robotics race has become explicitly competitive, with national alliances forming, governments coordinating industrial policy, and supply chain independence prioritized alongside technical capability. The era of collaborative global robotics development is ending; the era of competitive national robotics strategies has begun.

Want comprehensive coverage of the global humanoid robotics competition, including alliance developments, technology breakthroughs, and sports applications? Subscribe to the Humanoid Sports Network newsletter for regular updates on international humanoid developments, competition results, and analysis of which nations are winning the robotics race.