One of China’s “Big Four” automakers with 160+ years of history enters humanoid robot market, signaling massive shift in automotive industry toward embodied AI and sports applications

Changan Automobile, one of China’s top four automotive groups and its oldest with roots tracing back to 1862, has become the latest major Chinese carmaker to invest in humanoid robotics technology. The state owned manufacturer announced plans to invest 225 million yuan ($31.8 million) for a 50% stake in Changan Tianshu Intelligent Robotics Technology, marking a strategic expansion beyond traditional vehicle manufacturing into the rapidly growing robotics sector.

The move, announced via a Shenzhen Stock Exchange filing on November 28, 2024, positions Changan alongside Chinese automotive giants BYD, Xpeng, Xiaomi, and NIO, all of which are aggressively pursuing humanoid robot development as they seek to diversify revenue streams and leverage their electric vehicle expertise in emerging technologies.

From Military Arsenal to Robot Pioneer: Changan’s 162-Year Journey

Changan’s industrial history began in 1862 when a Chinese politician and general founded what would become the Shanghai Bureau of Marine Artillery during the Westernization Movement at the end of the Qing dynasty. The company transitioned from military production to civilian vehicle manufacturing in 1984, launching its first Changan-branded vehicles, the SC112 mini van and SC110 mini truck.

Today, Changan operates 14-16 manufacturing bases and 35-39 vehicle and engine plants globally, with cumulative sales of Chinese-branded vehicles exceeding 26.33 million units as of April 2024. The company employs over 18,000 engineers and technicians from 31 countries and maintains R&D centers across six countries, including facilities in Detroit, Turin, Birmingham, Munich, and Yokohama.

Strategic Robotics Pivot: “Two-Way Empowerment” Between Vehicles and Robots

Changan Tianshu Intelligent Robotics Technology has total registered capital of 450 million yuan ($63.6 million), with Changan contributing 50% directly and another 10% through a wholly owned subsidiary. According to the company’s exchange filing, the new subsidiary will be driven by intelligent humanoid robot technology and aims to develop multiple sectors of the robotics industry.

The strategic rationale centers on what Changan calls “two-way empowerment” between intelligent vehicles and robots, leveraging the company’s automotive AI, sensor technology, electric powertrains, and manufacturing expertise to accelerate robotics development while simultaneously using robotic innovations to enhance vehicle production.

The company’s digital intelligence factory in Chongqing already uses AI, 5G connectivity, and automated robotics to run fully automated production lines for new-energy vehicles, with one automated factory reportedly producing a finished electric vehicle every 60 seconds during operating hours.

At the Auto Guangzhou 2024 show in November, Changan announced it would release prototypes of self-developed humanoid robots starting in 2025, with plans to unveil its first in vehicle robot in Q1 2025. This timeline aligns with the company’s broader transformation strategy aimed at becoming what it describes as a “global embodied intelligence company.”

Chinese Automakers Race to Dominate Humanoid Robotics

Changan’s entry into humanoid robotics reflects a broader industrywide trend that has seen Chinese automotive manufacturers pivot aggressively toward robotics as a parallel revenue stream and competitive differentiator.

Xpeng: Most Aggressive Automotive Robot Developer

Xpeng plans to begin mass production of its IRON humanoid robot by the end of 2026, with CEO He Xiaopeng predicting the company will sell more robots than cars within the next decade. The IRON robot features over 60 joints, 200 degrees of freedom, stands 5’8″ tall, weighs 154 pounds, and utilizes solid-state battery technology along with Xpeng’s self-developed Turing AI chips delivering 3,000 TOPS of computing power.

In March, Xpeng vice-chairman Brian Gu predicted the robotics industry would become larger than the automotive sector within the next few years, highlighting the transformative revenue potential automakers see in humanoid technology.

BYD, GAC, Xiaomi, and Others Join the Race

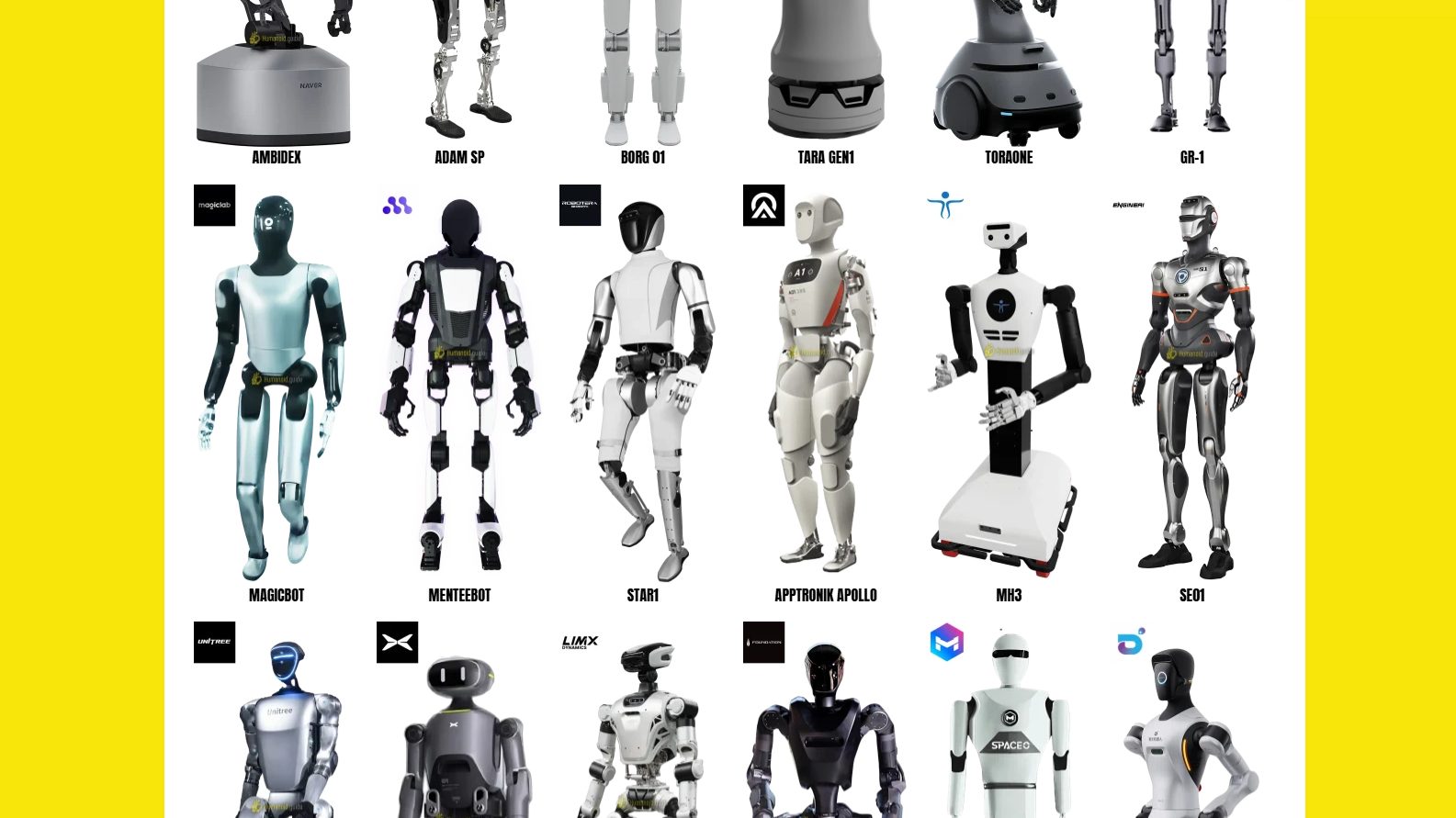

According to industry reports, approximately 18 global automakers have now entered the humanoid robot market. Beyond Changan and Xpeng, major Chinese players include:

- BYD: Investing millions in robotic projects while maintaining its position as China’s leading electric vehicle manufacturer

- GAC: Developed the GoMate humanoid robot integrating self-developed pure-vision autonomous-driving algorithms

- Xiaomi: Advancing phased rollout of its CyberOne humanoid robot (177cm tall, 52kg) on production lines, designed for home care and companionship applications

- NIO: Established humanoid robot team focused on underlying technologies including algorithms, dynamic perception, and large models

- Geely/Zeekr: Deployed UBTech’s Walker S Lite humanoid robot at its smart factory in Ningbo, where the robot carries loads up to 33 pounds from different pallets to assembly lines

Why Automakers Are Ideally Positioned for Robotics

Chinese EV makers possess significant expertise in areas crucial for humanoid robots, including electric powertrains, sensors, machine vision, artificial intelligence, and autonomous driving algorithms, according to EV research analyst Freya Zhang at Tech Buzz China.

This technological synergy allows automotive companies to rapidly adapt existing vehicle systems for robotic applications, a competitive advantage traditional robotics startups lack. Furthermore, automakers’ massive manufacturing scale, supply chain networks, and capital resources position them to achieve the mass production volumes necessary to bring down humanoid robot costs dramatically.

Implications for Humanoid Sports and Athletic Applications

While Changan and other automakers initially focus on industrial, commercial, and in vehicle robot applications, the technology being developed has direct implications for the emerging humanoid sports industry.

The same capabilities required for robots to navigate factory floors, interact with customers, and perform complex tasks, visual perception, dynamic balance, real-time decision making, autonomous movement, and recovery from disruptions, are precisely the competencies needed for competitive robotic athletics.

China demonstrated this connection vividly at the inaugural 2025 World Humanoid Robot Games held in Beijing from August 15-17, where approximately 500 robots from 16 countries competed in 26 sports including track and field, soccer, kickboxing, gymnastics, and table tennis. Zhao Mingguo, chief scientist at Booster Robotics, stated that playing football serves as a testing and training ground for refining capabilities destined for factory and home applications.

Notably, Unitree’s H1 robot, developed by another Chinese manufacturer, won gold medals in both the 400-meter and 1,500-meter races at the World Humanoid Robot Games, demonstrating that the rapid pace of Chinese humanoid development is producing robots capable of legitimate athletic performance.

As automotive companies like Changan invest billions in humanoid technology and drive production costs down through manufacturing scale, the accessibility of competitive-grade humanoid robots for sports applications will increase dramatically. Industry analysts project that declining robot costs combined with advancing capabilities could make humanoid sports a significant entertainment category within the next 5-10 years.

China’s National Robotics Strategy and Market Projections

Changan’s robotics investment aligns with China’s national strategy to dominate the humanoid robot industry. The Chinese Institute of Electronics projects that China’s humanoid robot market will reach 870 billion yuan ($120 billion) by 2030, representing one of the fastest-growing technology sectors globally.

This aggressive government-backed push has already yielded results. Research published by Morgan Stanley predicts that by 2050, China will have 302.3 million humanoid robots in use, well ahead of the U.S. projection of just 77.7 million.

Chinese cities including Beijing, Shanghai, Shenzhen, and Hangzhou are competing to become robotics innovation hubs, offering substantial subsidies, research funding, and regulatory support to companies developing humanoid technology. This ecosystem approach, combining corporate investment, government support, academic research, and manufacturing infrastructure, creates conditions for rapid advancement that Western competitors struggle to match.

Investment Opportunities in the Automotive-Robotics Convergence

The convergence of automotive and robotics industries creates substantial investment opportunities across multiple sectors. Investors seeking exposure to this trend can pursue various strategies, including:

- Public automotive stocks with robotics divisions (BYD, Xpeng, Xiaomi)

- Robotics component suppliers (actuators, sensors, AI chips)

- Chinese robotics unicorns like Unitree and EngineAI

- Robotics ETFs and funds with Chinese exposure

The recent success stories in Chinese robotics provide compelling precedent. UBTech Robotics reported sales hitting 1.3 billion yuan with surging orders for its Walker S2 humanoid, while the company also secured a $37 million contract to deploy self-battery-swapping humanoid robots at the China-Vietnam border.

Even newer companies are achieving remarkable feats. AgiBots’ A2 humanoid robot set a world record by walking 66 miles across China in just three days, demonstrating the rapid progress in endurance and reliability that makes robots increasingly viable for extended athletic competitions.

Global Competitive Implications

“The significant investments and progress being made by Chinese EV OEMs in the humanoid robot field signal a development that U.S. automakers will need to monitor and potentially respond to in the coming years,” warns Zhang of Tech Buzz China.

While American robotics leaders like Boston Dynamics maintain advantages in high-end research and innovation, Chinese companies are rapidly closing capability gaps while maintaining dramatic cost advantages. The same playbook that allowed Chinese EV makers to dominate global electric vehicle markets, massive government support, rapid iteration cycles, vertical integration, and aggressive pricing, is now being applied to humanoid robotics.

According to a South China Morning Post report, Beijing has warned about potential investment bubbles in the robotics sector as capital floods into the industry. However, this concern reflects the scale of investment rather than fundamental weakness, Chinese automakers and technology companies are deploying tens of billions of dollars into robotics development, creating an innovation ecosystem that Western competitors may struggle to match.

Western automotive companies have been slower to embrace humanoid robotics, with BMW being among the first to deploy humanoid robots (Figure 02 from California-based Figure) in production at its Spartanburg, South Carolina plant in August 2024. However, this remains pilot-scale deployment compared to the comprehensive robotics strategies Chinese automakers are implementing.

What This Means for Humanoid Sports

Changan’s entry into humanoid robotics, along with the broader trend of automotive companies developing bipedal robots, has significant implications for the emerging humanoid sports industry:

1. Accelerated Technology Development: Automotive companies bring massive R&D budgets, world class engineering talent, and rapid iteration capabilities that will accelerate humanoid capabilities across balance, speed, agility, and decision making, all critical for competitive sports.

2. Dramatic Cost Reductions: Mass production expertise from vehicle manufacturing will drive down humanoid robot costs from current levels of $16,000-50,000+ toward price points accessible to universities, sports organizations, and eventually individuals, dramatically expanding the competitive field.

3. Standardization and Reliability: Automotive engineering emphasizes safety, durability, and consistent performance, exactly what’s needed for robots to compete reliably in sports leagues without constant breakdowns or dangerous malfunctions.

4. Global Distribution Networks: Automakers’ existing global sales and service networks could facilitate international distribution of competition-grade humanoid robots, enabling truly global sports leagues.

5. Corporate Sponsorship Opportunities: As automotive companies develop humanoid sports capabilities, they gain powerful motivation to sponsor robot sports leagues and competitions as marketing platforms for their robotics technology.

The Road Ahead: From Factory Floors to Sports Arenas

Changan’s $31.8 million investment in humanoid robotics represents far more than a single company’s strategic diversification. It signals the automotive industry’s recognition that humanoid robots represent a market opportunity potentially exceeding the trillion dollar vehicle industry itself, and that the technology, manufacturing, and AI capabilities developed for autonomous vehicles transfer directly to bipedal robotics.

For the humanoid sports industry, this influx of automotive capital, engineering talent, and manufacturing capability accelerates the timeline for when competitive robot athletics transitions from experimental novelty to legitimate entertainment category. As robots from automotive backed developers compete in events ranging from soccer matches to combat sports to endurance racing, the technology will advance rapidly while costs decline, precisely the conditions needed for a viable sports industry to emerge.

The convergence of automotive and robotics industries isn’t just about making better cars or more capable robots, it’s about creating the technological foundation for an entirely new category of athletic entertainment that could eventually rival traditional sports in scale and cultural significance.

Stay ahead of the humanoid sports revolution. Subscribe to the Humanoid Sports Network newsletter for exclusive coverage of industry developments, competition results, investment opportunities, and technological breakthroughs shaping the future of robot athletics. Be the first to know as this transformative industry evolves from emerging technology to mainstream entertainment.